If you’re in charge of managing your business’ cash flow, you’ll need to understand the time that it takes for ACH transactions to process and settle. While processing speeds have increased significantly since its inception in the 1970s, ACH payments don’t happen in real-time and usually take a couple of days to “complete,” due to the verification process that occurs after a transaction “clears.” This post will introduce you to ACH settlement times.

ACH 101: An Introduction

ACH transactions work as a more efficient and cost-effective alternative to paper checks.

Transactions occur through the Automated Clearing House Network, which connects more than 25,000 financial institutions across the United States. ACH payments are governed by NACHA, which establishes and enforces the processes and rules for those transactions.

With ACH, transactions are processed in batches throughout the day, meaning they’re accumulated by the processor (and the financial institution) before being processed in bulk. You can learn more about how ACH works at the following link: ACH 101: Understanding the Automated Clearing House.

What are ACH settlement times, and why are they important?

An ACH settlement time, or “settlement period” is a predetermined number of banking days that payment processors hold onto your ACH Debit funds before they get deposited into your bank account. (It’s important to note that settlement periods do not apply to ACH Credits. When successfully submitted, ACH Credits always post to the Receiver’s account by 8:30 a.m. (Central) on the following banking day – or the same day if you’re using Same Day ACH. This post will focus on ACH Debits.)

Similar to paper checks, ACH transactions can be returned, or “bounce,” for a variety of reasons, such as insufficient funds, invalid or closed accounts, etc.

Unlike paper checks, however, the funds for ACH transactions are cleared between banks automatically, even before the RDFI, or the Receiving Depository Financial Institution (e.g., your customer’s bank) verifies the Receiver’s account or account balance, or the Receiving Depository Financial Institution (e.g., your customer’s bank).

RDFIs can automatically reverse those funds by submitting an ACH Return Code back to the ODFI, or the Originating Depository Financial Institution.

NACHA Rules state that RDFIs must return Debit Entries (excluding consumer-unauthorized transactions) within two banking days. While 99% of returns are received according to the rules, some may come in a day or two later. As a result, payment processors and banks enforce a settlement period before releasing the funds into your bank account, usually three (3) to five (5) business days.

How do settlement periods work with Actum?

As a third-party processor, Actum enforces both standard and accelerated settlement periods.

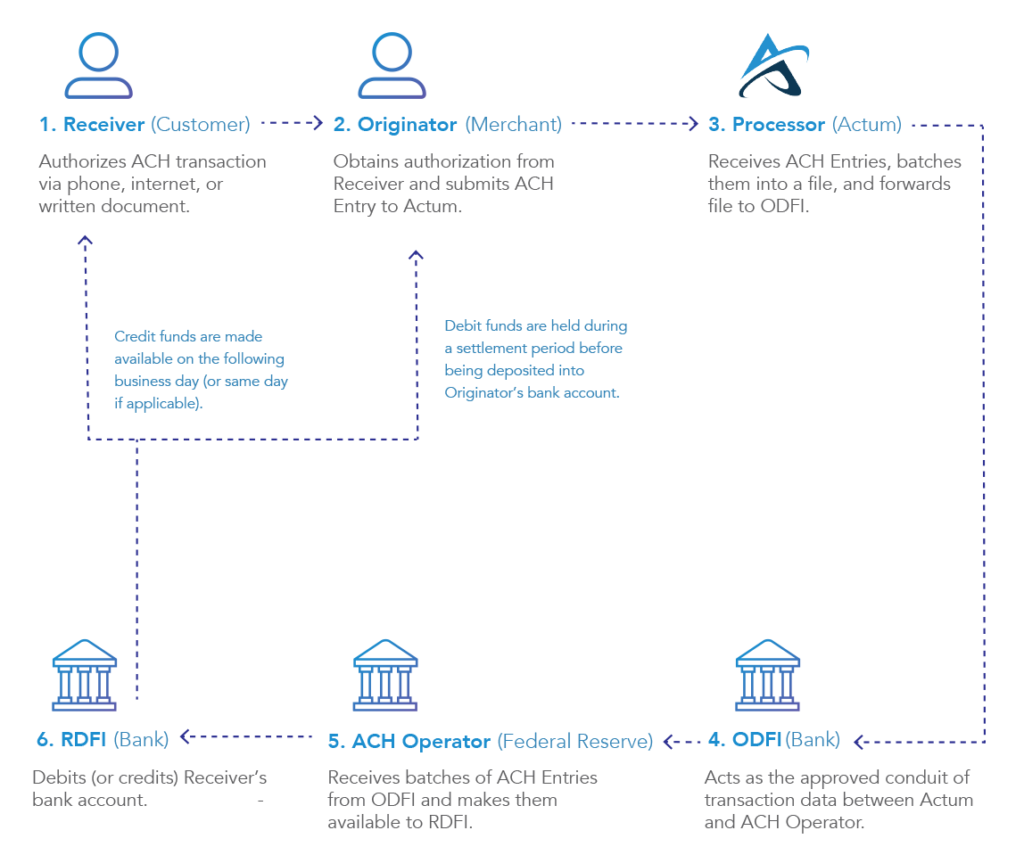

The following figure demonstrates an overview of how ACH transactions work with Actum:

Figure 1: Actum’s ACH Processing Flow

During settlement periods, a hold gets enforced on ACH Debits. (ACH Credit funds do not require the same level of verification and are made available to the Receiver on the same or next business day.)

Often, businesses want faster access to their ACH Debit funds. Many of our clients ask us how they can shorten their ACH settlement times. To that end, we offer Accelerated Payouts, including Next Day Payouts for qualified merchants. Accelerated Payouts shorten the settlement period times to two (2), one (1) or even zero (0) business days. While we encourage you to apply, each case is different, and our Underwriting Department evaluates your business on its financial strength and past performance to approve you for Accelerated Payouts.

Bottom Line: Key Takeaways

Understanding ACH settlement periods is a critical component of cash flow management. When evaluating payment processors, make sure that they offer options to reduce your settlement period and streamline your accounts receivable.

For more information about processing with Actum, we invite you to Contact Us!

![AdobeStock_145566067 [Converted]](https://www.actumprocessing.com/wp-content/uploads/2019/04/AdobeStock_145566067-Converted-768x512.png)