How Can We Help?

Accessing the Return Report

The Return Report provides transaction level detail regarding any returns received within a specific time frame.

1. Log in to the Actum Portal at https://merchant.actumprocessing.com. Refer to the Multi-Factor Authentication (MFA): How to Use via Actum Portal article for further login instructions.

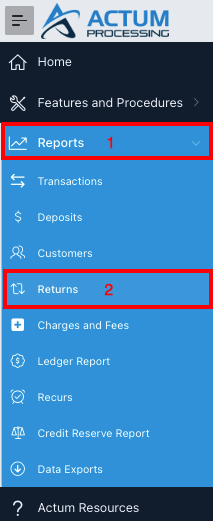

2. Select Reports and choose Returns.

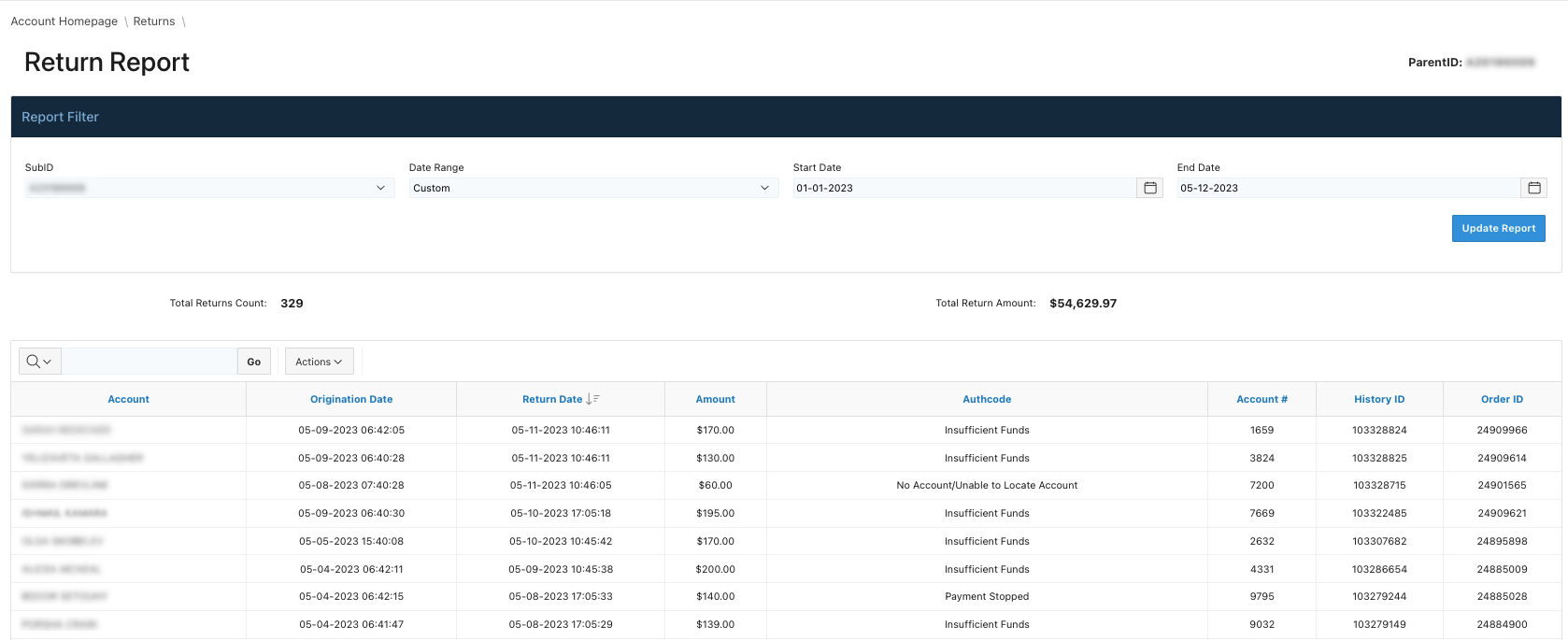

3. The Return Report populates with the latest returns and the return reason listed under the Authcode column.

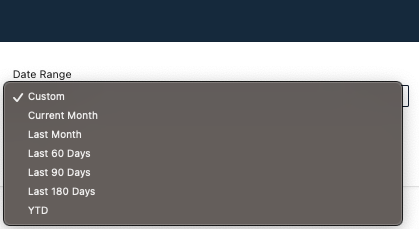

4. Adjust the Return Report’s Date Range by selecting the Date Range dropdown option and clicking on Update Report.

![]()

5. For clarification about the various types of ACH return codes, please review this entry.

NACHA Thresholds

Note: It is important to monitor your returns regularly to ensure they are in compliance of NACHA thresholds. Presently, NACHA thresholds are the following:

Administrative Returns must be under 3%

Chargebacks must be under 0.5%

Overall Returns must be under 15%

In most cases, returns can be managed and resolved by working closely with your customers/receivers of your ACH debit transactions. Ultimately, managing your returns can prove worthwhile in maximizing your ACH processing experience as an Actum Processing merchant.

Generally, submitted debit transactions may return within two to three business days following the date that it was submitted.

Tips

To reduce returns, here are some helpful tips with the specific return types that can happen with an Actum Processing merchant account:

Administrative Returns (R02 – Bank Account Closed, R03 – No Account/Unable to Locate Account, R04 – Invalid Account Number) – These returns occur as a result of outdated bank information. In addition, incorrect information was provided for the bank account. Obtain the latest copy of the client’s bank information with a voided check or bank letter to verify and confirm the bank information on the voided check or bank letter versus what was provided on an authorization form.

Chargebacks (R05 – Unauthorized Debit to Consumer Account Using Corporate SEC Code, R07 – Authorization Revoked by Customer, R10 – Customer Advises Originator is Not Known to Receiver and/or Originator is Not Authorized by Receiver to Debit Receiver’s Account, R11 – Customer Advises Entry Not in Accordance with the Terms of the Authorization, R29 – Corporate Customer Advises Not Authorized) – When a client files a chargeback, stop any anticipated debits while resolving the issue with the contested transaction. Any anticipated debit transactions may resume once resolving the chargeback.

NSF (Non-Sufficient Funds or Insufficient Funds, R01) – These returns occur when a client does not have the anticipated funds in their bank account for an anticipated debit. While a common return type, please be sure to contact your client in advance of an anticipated debit (about a business day or two) to ensure that you may proceed with the debit transaction.

Calculating the Return Ratios

While our Actum Portal provides a helpful snapshot of an account’s overall performance at the start of a new month on the primary page, it does not reflect real-time calculations of an account’s return ratios. However, here are some tips on how to calculate the latest return ratios which can be used to determine the Overall Return, Administrative Return and Unauthorized Return ratios for an account.

1. After logging in to the Actum Portal, select Transactions.

2. Set the Start Date to 60 days prior to the current date and the End Date to today’s date. For this example, Oct. 14, 2024, will be the Start Date and Dec. 13, 2024, will be the End Date. Then click Update Report.

3. The next steps are to get the total number of Debits (Standard, and if applicable, Same-Day Debits) that were submitted in this 60-day period. The Transaction Detail Report can be filtered first to display Standard Debits by clicking on Type and choosing Debit.

4. The Transaction Detail Report will not always show all the Debit transactions in the page. In this case, to see all Debit transactions, click on Actions, choose Format, select Rows Per Page and click All.

5. Depending on how many Debit transactions were processed in the 60-day period, the important takeaway is to get the total number of Debit transactions found in the bottom of the page. In this case, the total number of Debit transactions submitted in the 60-day period for the example is 1,320.

6. Now, if any Same-Day Debit transactions were processed in the 60-day period, first, click the X button to the right of the filter window that shows “Type = ‘Debit'” to reset the results.

7. Click on Type and choose Same-Day Debit.

8. Scroll to the bottom of the page to see the number of Same-Day Debit transactions submitted in the 60-day period. This number will be found on the bottom right side of the page. For this example, it will be 16 Same-Day Debit transactions.

9. Now, add the number of Same-Day Debit transactions with the number of Debit transactions submitted in the 60-day period to calculate the number of total Debit transactions submitted in this time frame. For this example, add 16 + 1,320 and the result is 1,336.

10. Click the X button to the right of the filter window that shows “Type = ‘Same-Day Debit'” to reset the results.

11. To determine the number of Returns in the 60-day period, click Type and choose Return.

12. Scroll to the bottom of the page to see the number of Returns from the 60-day period listed on the bottom right hand side. For this example, there were 278 Returns.

13. Click the X button to the right of the filter window that shows “Type = ‘Return'” to reset the results.

14. To see if there were any Late Returns during the 60-day period, click Type and choose Late Return.

15. Scroll to the bottom of the page to see the number of Late Returns from the 60-day period listed on the bottom right hand side. For this example, there were two Late Returns. Recalling for this example that there were 278 Returns, we can conclude there were 280 total Returns in the 60-day period.

16. In order to calculate the return ratios for the 60-day period, remember these formulas.

Overall Returns: No. of Total Returns / No. of Debit Transactions (Standard and Same-Day Debits)

Administrative Returns: No. of Administrative Returns (please refer to this Knowledge Base entry to determine the Return Type) / No. of Debit Transactions (Standard and Same-Day Debits)

Unauthorized Returns: No. of Unauthorized Returns (please refer to this Knowledge Base entry to determine the Return Type) / No. of Debit Transactions (Standard and Same-Day Debits)

For the example, here are the return ratios.

Overall Returns: 280 Returns/1,336 total Debit transactions (Standard and Same-Day Debit transactions) = 0.2095808 X 100 = 20.95808% (rounded to 20.96%; 5.96% higher than NACHA threshold of 15%)

Administrative Returns: 1 Administrative Return/1,336 total Debit transactions (Standard and Same-Day Debit transactions) = 0.0007485 X 100 = 0.07485% (rounded to 0.08%; 2.92% lower than NACHA threshold of 3%)

Unauthorized Returns: 39 Unauthorized Returns/1,336 total Debit transactions (Standard and Same-Day Debit transactions) = 0.0291916 X 100 = 2.1916% (rounded to 2.19%; 1.095% higher than NACHA threshold of 0.5%)

Miscellaneous

There are instances in which a Return may be received after the window the ACH Rules allow for (Untimely Return). Originators have the right to dishonor an Untimely Return within five (5) banking days. Should the RDFI contest the dishonor by returning the item again, that is the end of the process on the ACH Network. Please see the NACH Operating Rules for more details.

Additional Resource

For further information, please review our interactive Scribe entry.